Welcome to the financial revolution. If you’re a Crypto Newbie, you’re likely caught in a classic dilemma: the intense “Fear of Missing Out” (FOMO) on explosive market gains versus the desire for “Stability” and capital preservation. This “financial whiplash” defines the modern investor. You see the headlines of soaring crypto prices, but you also hear the warnings of volatility. How do you participate in the upside without risking your hard-earned savings? This is where a professional framework becomes essential. This in-depth analysis explores the key crypto trends for 2025 and presents a strategic path for new traders, centered around the opportunities provided by Hola Prime.

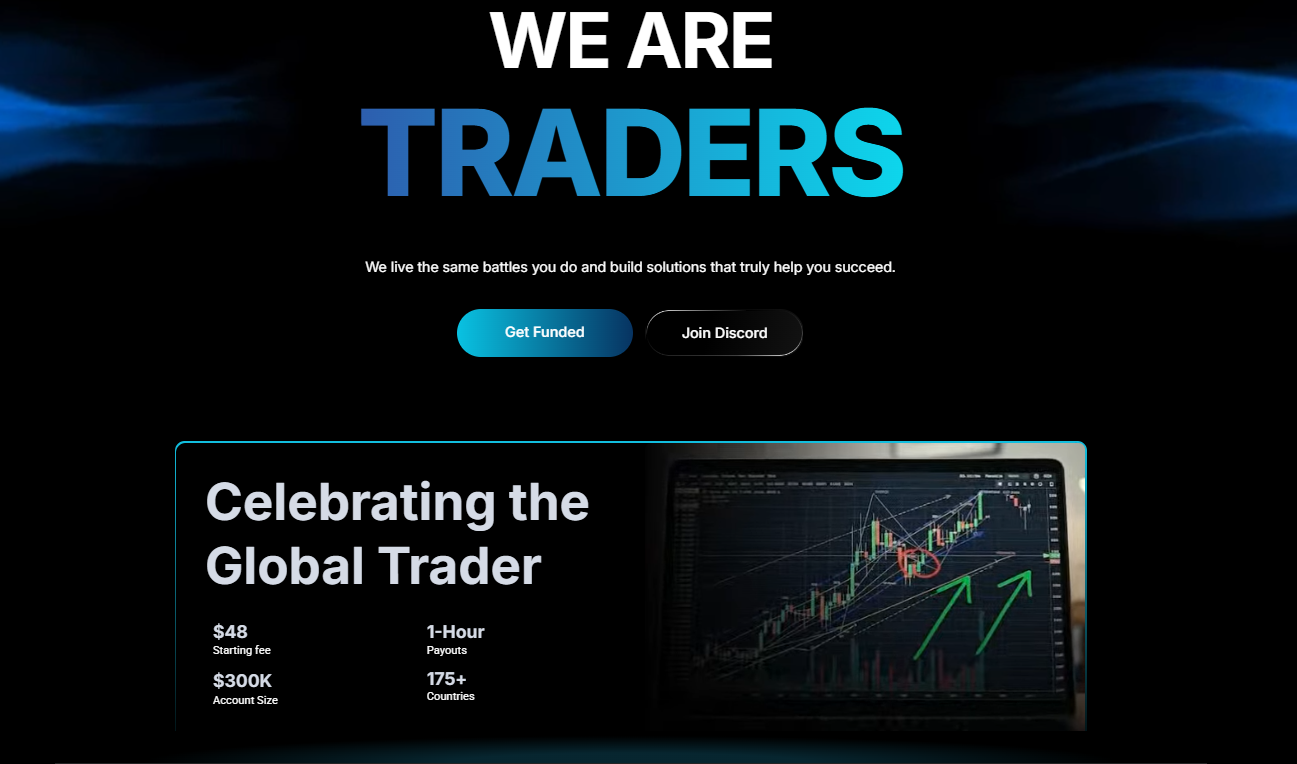

The challenge for any new trader is twofold: learning to analyze the market and accessing enough capital to make meaningful trades. This is precisely the problem that a proprietary trading (prop) firm solves. This guide will serve as your comprehensive introduction to professional-grade crypto analysis and how you can leverage a platform like Hola Prime to build your trading career. We will move beyond the hype and focus on actionable strategies, risk management, and the verifiable metrics that define a trustworthy trading partner.

What is Hola Prime and Why Does It Matter for Crypto Newbies?

Before diving into market analysis, let’s establish the platform. What is Hola Prime?

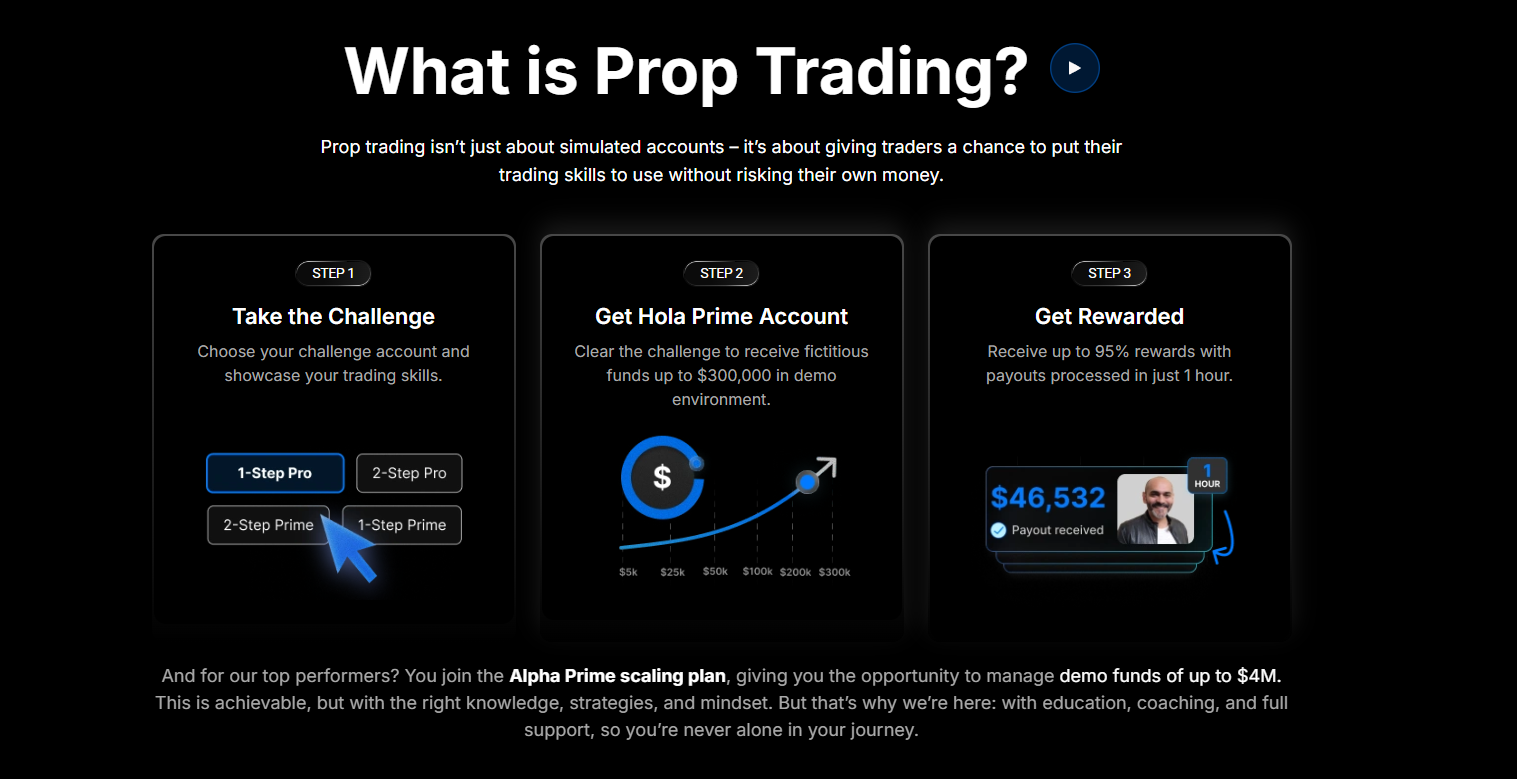

Hola Prime is a proprietary trading firm, often called a “prop firm.” The concept is simple but powerful:

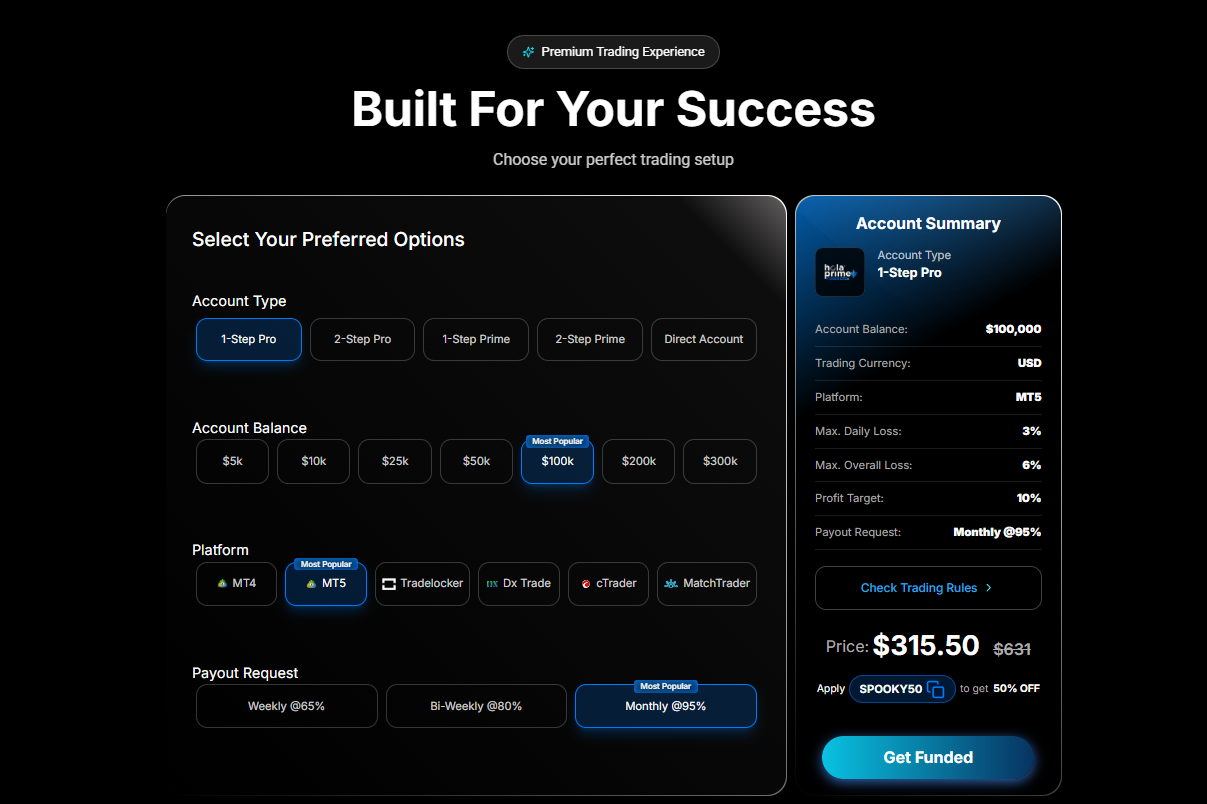

- Prove Your Skill: Instead of depositing your own money, you pay a fee to take a trading “Challenge” or “Evaluation.” This tests your ability to trade profitably while managing risk according to a set of clear rules.

- Get Funded: Once you pass the challenge, Hola Prime provides you with a significant funded account (which can range from thousands to hundreds of thousands of dollars).

- Trade and Split Profits: You trade the firm’s capital—including Hola Prime crypto and Hola Prime Futures assets—and keep the majority of the profits you make, often up to 95%.

For a Crypto Newbie, this model is revolutionary. It systematically solves your biggest problems:

- Eliminates Significant Personal Risk: You are not risking your life savings. Your only financial exposure is the initial evaluation fee.

- Provides Leverage: It gives you access to institutional-sized capital, allowing you to generate substantial Hola Prime payouts from small, consistent market movements.

- Enforces Discipline: The holaprime rules (which we’ll cover later) force you to learn and apply professional risk management, curing the bad habits that wipe out most new retail traders.

Pro Trader Concept: The “Barbell Strategy”

This model, popularized by author Nassim Taleb as the “Barbell Strategy,” allows you to protect your “Stability” (your savings) while giving you controlled, high-upside exposure to the “FOMO” end of the investment spectrum.

The 2025 Crypto Landscape: An In-Depth Trend Analysis

To succeed in a holaprime funded account, you can’t just guess. You must understand the major forces shaping the market. The crypto landscape of 2025 is fundamentally different from the speculative frenzy of previous years. We are now in a phase of professionalization and integration.

Trend 1: The Great Institutional Integration

The single biggest trend of this cycle is the legitimization of crypto as an institutional asset class. The launch and massive success of Spot Bitcoin ETFs in the U.S. acted as a gateway, pouring billions of dollars into the market.

The Impact: This creates a more stable price floor and reduces the kind of extreme volatility seen in crypto’s early days.

Citation: As of early 2025, the total crypto market capitalization has consistently held above the $4 trillion threshold, a landmark moment driven largely by institutional inflows. [Citation: Reports from blockchain analytics firms like a16z Crypto’s “State of Crypto 2025”].

For the Newbie: This means your analysis is more likely to be respected. Trends are driven less by pure retail hype and more by structured financial flows, making technical and fundamental analysis more reliable.

Trend 2: Stablecoins Become the Global Settlement Layer

Forget seeing stablecoins (like USDC or USDT) as just a way to “park” funds. In 2025, they are a dominant financial tool.

The Impact: Stablecoins are now used for global payroll, B2B payments, and cross-border settlements, completely bypassing old banking rails.

Citation: On-chain stablecoin settlement volume has exploded, with adjusted volumes approaching $1.25 trillion per month in late 2025. This volume now rivals that of traditional payment giants like Visa or PayPal. [Citation: a16z Crypto, “State of Crypto Report 2025”].

For the Newbie: This creates massive liquidity and utility for the entire crypto ecosystem. It also provides a stable asset for you to hold within your trading platform between trades, without having to off-ramp to fiat.

Trend 3: The Convergence of AI and Decentralized Finance (DeFi)

The two biggest tech narratives—Artificial Intelligence and Crypto—are beginning to merge. AI agents are being developed to automate complex DeFi strategies, manage liquidity, and even execute trades.

The Impact: This will lead to more efficient, (and more competitive), markets.

Citation: Experts predict that by the end of 2025, AI-driven trading bots and autonomous agents will account for a significant portion of all trading volume on decentralized exchanges. [Citation: “Top 10 Crypto Market Predictions for 2025,” 101 Blockchains].

For the Newbie: While you don’t need to be an AI expert, you must be aware that you are trading in a market where automated, data-driven strategies are common. A clear, human-led strategy is your best defense.

Foundational Analysis: A Crypto Newbie’s Guide

Understanding these macro trends is the first step. The next is learning to analyze specific assets. This is the skill that will pass your hola prime prop firm challenge. There are three main pillars of analysis.

Pillar 1: Fundamental Analysis (FA) – The “Why”

FA seeks to determine a crypto asset’s intrinsic value. You are asking, “Does this project have a real purpose and a chance of long-term success?”

The Whitepaper

This is the project’s business plan. Is it clear, professional, and does it solve a real problem?

The Team

Are the developers public (doxxed)? Do they have a proven track record?

Tokenomics

This is the economics of the token.

- Supply: Is there a max supply (like Bitcoin), or is it inflationary?

- Distribution: Was the token fairly launched, or do the founders and VCs hold 90%?

- Utility: What is the token used for? Is it for paying network fees (like ETH), governance (voting), or just speculation?

Real-World Example

A project with strong FA (clear utility, experienced team, fair token distribution) is more likely to survive a bear market and thrive long-term. A project with weak FA is a gamble.

For a deep dive into these concepts, Investopedia’s guide on Fundamental Analysis for Cryptocurrency is an excellent starting point.

Pillar 2: Technical Analysis (TA) – The “When”

TA uses price charts and trading statistics to identify patterns and trends that can predict future price movements. This will be your primary tool for day-to-day trading, especially when trading Hola Prime Futures.

Candlestick Charts

Learn to read them. A green (bullish) candle means the price closed higher than it opened; a red (bearish) candle means it closed lower. The “wicks” show the high and low of the period.

Support & Resistance

These are price levels where the market has historically bounced (support) or been rejected (resistance). Buying at support and selling at resistance is a foundational strategy.

Volume

High trading volume confirms a trend. A price breakout on low volume is often a “fakeout.”

Indicators

Tools like the Relative Strength Index (RSI) help you identify “overbought” or “oversold” conditions, while Moving Averages (MAs) help you identify the overall trend direction.

Pillar 3: Sentimental & On-Chain Analysis – The “Vibe”

This is a newer form of analysis unique to crypto.

Sentimental Analysis

What is the general market mood? Is the “Crypto Fear & Greed Index” at “Extreme Greed” (a potential time to be cautious) or “Extreme Fear” (a potential buying opportunity)? Monitoring platforms like X (Twitter) and discussions like holaprime reddit threads can give you a raw, real-time pulse on market sentiment.

On-Chain Analysis

Because blockchains are public, you can view data directly. How many active addresses are there? Are large “whale” wallets accumulating or selling? This data, while more advanced, provides a transparent look at what is actually happening on the network.

A successful trader at Hola Prima (a common misspelling of Hola Prime) combines all three. FA finds what to buy, TA finds when to buy, and Sentimental/On-Chain analysis confirms if the market agrees.

A Newbie’s Strategy for Passing a Prop Firm Challenge

Knowing analysis is one thing. Applying it under pressure is another. The holaprime funded challenge is a test of consistency. Here is your strategic plan.

Step 1: Internalize the holaprime rules

This is the most important step. Failure to follow the rules means you fail the challenge, even if you are profitable. The two most critical rules are:

Critical Rules to Master

- Max Daily Drawdown: The maximum amount your account can lose in a single day (e.g., 5%).

- Max Total Drawdown: The maximum total amount your account can fall from its peak (e.g., 10%).

These rules are not your enemy. They are your guardrails. They force you to practice the #1 skill of all professional traders: cut your losses short.

Step 2: Develop ONE Simple, Repeatable Strategy

Newbies fail by “strategy hopping.” They use MAs one day, RSI the next, and follow a social media “guru” the day after.

Instead, pick one simple strategy and master it. An example:

Example: Simple MA Pullback Strategy

- Asset: ETH/USD

- Timeframe: 1-Hour Chart

- Signal: Wait for the price to pull back to the 50-period moving average (a support level).

- Entry: When a bullish candlestick pattern forms at the MA.

- Exit (Loss): Place a stop-loss just below the MA (respecting your Max Daily Drawdown).

- Exit (Profit): Set a profit target that is at least 1.5x your stop-loss (a 1.5:1 Risk/Reward Ratio).

This is just an example. The key is to have a written plan and stick to it. You can find more strategy guides and market updates on the Hola Prime News Blog.

Step 3: Risk Management is the Key to holaprime payouts

Let’s be clear: you will have losing trades. Every pro does. The difference is how they manage them. Your goal is not to be right 100% of the time. Your goal is to make more on your winners than you lose on your losers.

A professional trader using the trader.holaprime.com dashboard risks only 1-2% of their account per trade. This ensures that a string of 5 or 6 losses doesn’t wipe them out. It allows them to survive long enough to hit their winning streaks. This discipline is what ultimately leads to consistent Hola Prime payouts.

Is Hola Prime Legit? Navigating Reviews and Due Diligence

A crucial part of your analysis is choosing the right partner. When you search for any prop firm, you’ll find a storm of opinions, from glowing testimonials to harsh criticisms on forums. The LSI keyword “is holaprime legit” is a common and important question.

The prop firm industry has seen explosive growth, and with it, some bad actors who use fake reviews or have unclear rules. Reputable financial news sites like Finance Magnates have even reported on firms having fake reviews removed from platforms like Trustpilot.

So, how do you find the truth? You must ignore the noise and focus on verifiable signals. Instead of getting lost in a holaprime reddit thread, ask these professional questions:

- Are the Rules Clear and Transparent? A legit firm has nothing to hide. The holaprime rules are published clearly: you know your profit targets, drawdown limits, and profit split percentages upfront. There are no hidden “gotchas.”

- Is the Technology Robust? Does the firm offer reputable trading platforms like MetaTrader 5 (MT5), cTrader, or DXtrade? Hola Prime provides access to these industry-standard platforms, not a buggy, proprietary web app.

- Are the Payouts Fast and Reliable? This is the ultimate test. Hola Prime builds its reputation on its 1-hour payout system. This is a verifiable claim that separates them from firms that delay or deny withdrawals.

- Are They a Real Company? Is Holaprime Limited (the potential legal entity) a registered company? A legit firm has a corporate structure.

Your due diligence should be as thorough as your market analysis. Look for transparency, proven technology, and a clear payout process.

Beyond the Challenge: Growing with Hola Prime

Passing your challenge is just the beginning. Your journey as a trader evolves.

Scaling Your Account

As you prove your consistency, Hola Prime offers scaling plans, increasing your funded account size and profit potential.

Exploring New Markets

Once you master Hola Prime crypto spot trading, you can expand your skills into more complex instruments like Hola Prime Futures, which allow you to profit from both rising and falling markets.

Joining the Community

The holaprime affiliate program allows you to earn by referring other successful traders, creating an additional income stream and helping to build a community of professionals.

This in-depth crypto analysis is just one of many resources we offer.

Conclusion: Your Next Step in Crypto Trading with Hola Prime

The 2025 crypto market is not a lottery ticket. It is the most dynamic and opportunity-rich asset class of our generation, and it demands professionalism. For the Crypto Newbie stuck between FOMO and stability, the path forward is clear: education and a structured environment.

You must learn the skills of fundamental, technical, and sentimental analysis. But more importantly, you need a platform that lets you use those skills without risking your financial future.

This is the promise of Hola Prime. It provides the capital, the technology, and the rule-based framework for you to transition from a “newbie” to a professional, funded trader. Your analysis, combined with our capital, is the formula for success.

Are you ready to stop gambling and start trading?

Ready to Prove Your Skill?

Join the new generation of traders. Take the Hola Prime challenge, get funded, and start your professional crypto trading career today.

Sign Up for Your Hola Prime Challenge Now!Disclaimer: Trading in financial markets, including cryptocurrencies and futures, involves substantial risk and is not suitable for every investor. All content in this article is for educational and informational purposes only and should not be considered financial advice. Past performance is not indicative of future results.